S&P 500 Annualized Returns – Business Insider

See Also

This Crazy Chart Perfectly Illustrates Why You Should Never Expect ‘Average’ Returns

This Brilliant Chart Reveals How Patience Pays Off For Investors

We’ve Seen Uglier Stock Market Sell-Offs In 2013, 2012, 2011, 2010…

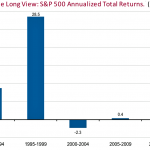

Regular 10% returns per year in the stock market are a myth. So are 9% returns and 11% returns.

In introductory finance courses, you might be taught that the stock market climbs around 10% per year. While this might be true historically when you’re talking about long-run, annualizaed average returns, it’s actually quite rare to have individual years that actually 10% returns.

Even over extended periods, it’s hard to see any pattern of stable annualized returns.

US Trust’s Joseph Quinlan illustrates this reality about stock market returns in the chart above.

In the past five years, we’ve actually experienced stellar 15.6% annualized returns. That’s certainly a nice surprise for anyone expecting 10% returns.

“Interestingly, notwithstanding the robust returns of this decade, five-year annualized returns over the second half of the 1990s were even stronger—tallying +28.5% between 1995 and 1999,” Quinlan noted in a Nov. 24 report. “Then, of course, the technology sector led the way, buoyed and fueled by the dot-com boom that resulted in the technology sector posting staggering +52.3% returns over the 1995 – 1999 period. However, the good times, as we all know, ended shortly thereafter.”

Over the two five-year periods before the current one, returns were between nil to negative.

For investors, this is something to keep in mind. You might experience long periods of better-than-expected returns. And you might also experience long periods of horrific losses.

Regardless, an expectation for 10% per year is just unreasonable, and it’s likely to feed into bad short-term investing decisions.

NOTE: Regarding the long-run future returns, there are some folks who expect little to no annualized returns for years, and others who expect high-single-digit to low-double-digit returns. Again, those are annualized returns. Both of those camps would probably agree that there’ll be some years where returns will way outside of their long-run average forecasts.

SEE ALSO: If You Missed The Rally, Then You Just Made The Most Classic Mistake In Investing

Continued:

S&P 500 Annualized Returns – Business Insider