Stock Market Top-Callers Are Missing One Key Ingredient | Stock …

Ding Dong! The Wicked Bull Is Dead

If you follow the markets, you may have noticed a recent increase in “the bull is over” articles. While it is entirely possible the S&P 500 has already peaked, the evidence says it may be a bit early to declare the dawn of a new S&P 500 bear market.

What Do The Facts Tell Us Now?

Regular readers know we are not fans of forecasting (bullish or bearish). Therefore, our purpose here is not to counter bearish arguments with bullish arguments, but rather to stop and look at some facts in place as of May 28, 2015.

Cannot Have A Bear Without This

Corrections and bear markets have one thing in common – they both feature the S&P 500 making a series of lower highs and lower lows.

Lower Low Came In October 2007

The chart below shows the S&P 500’s topping process as the bull market ended in October 2007. With the S&P 500 still trading at 1550, a lower high was made in October 2007. To have a bearish trend, we have to have a lower low as well – one was made in November 2007.

Lower Lows Come During Corrections

Just as day follows night, lower lows follow lower highs during multi-month stock market corrections. A lower high was made in early July 2011 – stocks did not find a bottom until several weeks later (see chart below).

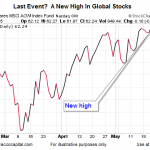

Most Recent Event – Higher Highs

Has the S&P 500 recently made a lower high followed by a lower low? No, in fact the last significant event was a higher high.

NASDAQ Made A New High Yesterday

Markets make new highs when the net aggregate opinion of all market participants is bullish. If the net aggregate opinion was bearish, bullish conviction would be too low to push stocks to a new high. How long has it been since a new high was made by the NASDAQ? Answer: One day.

Global Stocks Are Weak, Right?

The ACWI All-World ETF (ACWI) has exposure to stocks around the globe. ACWI made a new high last week, meaning the global stock bears have some work to do.

Talking About A Minimum Threshold For Bears

If we see a lower high and lower low, does it spell doom for stocks? No, lower highs and lower lows are made all the time. The point is a lower high and lower low is one of the easiest bearish thresholds to cross, and yet, it has not happened as of May 28, 2015. Until one of the easier to check off bearish boxes is checked, some patience remains in order before participating in the nearly impossible game of picking stock market tops.

How Helpful Were These Calls For Gloom And Doom?

A May 11 article looks at dated article titles, such as “Warning: Crash dead ahead. Sell. Get liquid. Now”, allowing you to make a call on their value to investors.

If They Have Trouble With Football…

If the best football handicappers cannot predict the outcome of NFL football games with accuracy much better than a flip of a coin, how reliable can we expect market forecasters to be when trying to call a much more complex system known as the global economy and global stock markets?

Bears May Get A Boost Friday…They May Not

Friday brings the latest reading on the U.S. economy. Rather than attempt to predict (a) the GDP number, and (b) the market’s reaction to the number, our approach calls for taking it day by day. If the evidence, including a discernible lower high and lower low, calls for a reduction in equity exposure, we are happy to do it. Are we perma-bulls? No, the charts say what they say and are not impacted by our personal views or human biases. Are there things to be concerned about? Yes, a few “be careful” items are outlined in this video clip.

Original article:

Stock Market Top-Callers Are Missing One Key Ingredient | Stock …