the stock market is long in the tooth today, Nov 18, 2014

the stock market is long in the tooth today, Nov 18, 2014

fiction

Edward w Pritchard

Stock prices are at highs but most regular folks and even lots of hedge funds are missing the party. Several hedge funds will close soon, unable to out perform the market. Should someone fortunate enough to have money invested in stocks stay at the party? Or should they be prudent and remove half their profits in stock funds and wait and see if the five year bull market will continue now that the Federal reserve has expressed their intention to stop supporting sub-normal low interest rates by pumping money into the US financial system. QE-3 is done, and with it will go the impetuous that drove the stock market and your 401K funds higher every couple of months. Soon the bull market party will end; at least the bull market party will end for a while which will end this round of fun, hopes and dreams of riches.

Where did all that QE3 money end up? I learned recently that the best acting ETF the last three years was IBB- biotech. Hopes, dreams and some fantasies of phase three trials to combine one or two experimental therapies to cure stubborn cancers or other dreaded diseases. Earlier on this blog I wrote of two bio-techs I follow: DNDN-dendreon, which has a successful $93,000 regiment drug for prostate cancer and INO-Inovio which has some excellent drug prospects as well. DNDN recently filed chapter 11, the bondholders have just about taken out the equity [stock holders]. Equity investors in DNDN lost all their money. Inovio has also lost another big pharma partner, Roche, and INO now will need to raise more money to proceed with phase 2 and three trials of their hot prospect drugs and treatments. Raise money equals dilution to existing shareholders.

What does it mean? The bull market is long in the tooth. Raise some cash and watch the show from your office as you continue to make a good living. As the bull market and the business cycle moves from phase to phase different stocks and assets classes out and under perform. Review your portfolio and take action if called for. No more fantasy, no more delusions of riches. Unfortunately, as I have ruefully found out, hard work is the only path to riches and it’s seems to be a treacherous slope.

Here’s what I wrote earlier this year on the Bull market. Take heed- do you know where your money is today?

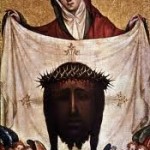

first wall street trading day 2014; and Saint Veronica with the Sudarium

fiction

Edward w Pritchard

What should we worship?

Veronica was a creation of legend. When Jesus was carrying the cross to be crucified Saint Veronica offered Christ her veil. The veil became imprinted with the face of Jesus. The picture of Christ on a veil became a popular image and pilgrimage to Rome to view a Sudarium earned one many indulgences in the Middle ages. It was also thought viewing the image protected one from sudden death.

Rather than contemplate Christ suffering horribly on the cross it is softer to view his sad face staring at us across the ages. The Sudarium was a different way of looking at the familiar information central to Christianity. The image presented above by the Master of St. Veronica, Cologne 1400 presents Jesus’ sorrow without the brutal edge of the Cross and Crucifixion.

The first day of stock trading in 2014 resulted in a drop in the Dow of 135 points. Is it as January goes so goes the year for Stocks or as January’s first trading day so goes the year? If so not a good start to the trading year of 2014. Seventy five percent of advisers seem to be bullish. Was today’s losses profit taking from the year end run up, a traditional January effect, or an augury of something more? Nearly every prognosticator expects a bullish year for stocks in 2014.

What are the futures telling you?

What does the year hold for the American stock market? Do we need a new way of looking at the same old information? Can anyone accurately predict the stock market and the future?

Bullish or bearish in 2014. Day by day yesterday’s predictions become exposed to reality.

Is the January effect or a first trading day of January prediction model a case of over elaborate data mining? Yale Hirsch, author of ” Don’t sell stocks on Monday ” back in 1986 wrote ” while stocks do indeed fluctuate, they do so in well defined, often predictable patterns which reoccur too frequently to be the result of chance or coincidence.”

Is all of existence random; explainable as one interaction followed by another ad infinitum? Or is there a underlying pattern to everything, caused and created by who knows what or who knows whom?

What should we worship? Oracles and auguries abound, the future is certain we are told. Who knows what will happen tomorrow? What are the futures telling you?

Who will you worship?

Jump to original:

the stock market is long in the tooth today, Nov 18, 2014

See which stocks are being affected by Social Media