What the China stock market crash means for startups | VentureBeat …

The China stock market downturn and currency changes have started to impact the global market. With 50+ startups in my firm’s global portfolio and a fast growing startup of my own, I thought it would be very timely to discuss what is happening in China and it’s potential impact on startups.

So I jumped on a call with Vaughn Tan, Assistant Professor at University College London (UCL)’s School of Management Strategy and Entrepreneurship Group. Vaughn is also a fellow of the Institute for Data-driven Design and received a PhD in Organizational Behavior from Harvard in 2013. In this chat we discuss the current situation in China, what startup founders should do to prepare for a potential global slowdown/crash, and how to manage for rapid change impacting your business.

Frank: Tell us a bit about yourself

Vaughn: I’m originally from Singapore, and moved to London a couple of years ago. My research deals with how individuals and organizations can deal with uncertain environments, which are different from risky environments. I think about how groups can organize themselves to deal with uncertainty, and help them understand their goals better so they can better respond to events like a stock market crash.

Frank: The issues in China have started to really impact the global markets. How do you see the state of the world at the moment, and will China continue to have a significant effect on the world economy or not?

Vaughn: I would begin by framing how I think about “big countries”, such as China. Firstly, the bigger and more complex the economy — the more uncertain it is. The more things that are interacting, the larger the system, the harder it is to predict what is going to happen in the future. Now, what’s been interesting with China is that not only is it large and complex, it is also moving considerably fast because it is such a large and desirable economy to participate in. People are piling in, and as they pile in, things start to move faster. The movement of capital flows inside and outside of China have been accelerating in the last few years, and when you have the combination of large size, complexity, and speed, you have the situation where you really are very uncertain about what is going on. China is in that situation now.

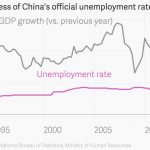

Adding to that, there is something about the macro economics of China that people have been talking about that deserves a bit more attention. Whenever we look at the macro-economic data of a country, we look at statistics mostly, sometimes from single sources and sometimes from a whole bunch of sources. But with an economy as large and as complex as China, you sometimes have to wonder if if the numbers you are getting are accurate, or indeed if they can be accurate. It’s very difficult to measure unemployment in a country like China with such a massive rural population, and it’s very difficult to keep it up to date. The official unemployment data as seen in the Atlas graph below, has had an eerie stillness to it that suggests that it may not be entirely accurate.

At the moment, China does not feel to me to be as stable as people want it to be, considering how much they are now exposed to it. Added to that is the uncertainty that comes from not knowing whether the measurements of the statistics that we use to understand the state of the economy are themselves accurate or if they can be.

One other thought — the fast moving nature of China has made it a desirable place to go. The speed of production, the vast customer base, the ever evolving economy makes you want to be there. However, things that we want out of an investment environment — stability, predictability — those are things that don’t work very well in the China context simply because of all the things I’ve said before. So all told, China does not feel like a place I would feel very comfortable being highly exposed to at this time, unless I was comfortable with a highly heterogeneous set of outcomes.

Frank: Now, in particular for startups and founders who are looking at what is going on at a world level, what type of advice do you give?

Vaughn: Let me start by saying it is very difficult to prepare for uncertainty, and also make a long term sustainable profit. Across the vast majority of startups, you will have to make a trade-off between being ready for an unpredictable future, and exploiting the present. What I mean by this, is that if you want to make strong profits now, or if you are an early stage startup that has a tight burn rate, that doesn’t give you much slack to prepare for the future.

Being prepared for uncertainty is the same for a large organization as it is for a startup. It means having extra resources that aren’t currently being used — that look like inefficiency or waste — that might be useful when the current environment changes. That change could be a macro-economic change, or a new technology for instance. It’s very difficult to plan for though: even if you invest in extra resources to be ready for uncertainty, you can’t guarantee that your extra resources will be appropriate for whatever change occurs.

Frank: Talking about extra resources, my advice to startups in situations like this, is that if you haven’t got revenue generators in place, you need to think about it and implement them quickly. Because in an investment downturn that is what will get you through the hard times. What do you normally see in situations like this, what do investors normally do and how should CEO’s plan?

Vaughn: What normally happens is flight to safety. When markets turn unstable and begin to be perceived as poor places to make high returns, capital flows toward perceived stability (even when it means low returns) — like real estate and bonds. But low risk real estate, not speculative real estate. I expect money to start flowing into geo-politically stable regions. London, for instance, will probably continue to receive large infusions of external capital.

Your point about concentrating on revenues, rather than depending on external streams of capital makes a lot of sense for startups in times of uncertainty like this. Intermediate product development is what I suggest for a startup CEO working out what to do in the event of the stock market crash accelerating and investors being more cautious.

You should not be trying to build that massive product that you hope will be a total market killer, you should instead be focusing on intermediate product steps that generate revenue and help you figure out what the product might eventually become. Monetizable intermediate product is a good way to learn about the market and do small-scale hypothesis testing, but it is also a way to free yourself from the constraints of needing external financing.”

You can prepare for uncertainty not just by stockpiling cash, but also by:

having a company culture that can assess and adapt to rapidly changing environments.

having product teams that are able to build and release something small that is part of a bigger product without having to build the entirety of the “big product” first.

having investors that are wise enough to support you as a CEO as you work through ideas that may seem very different but are responding to fast change around you.

All of those things are important to build up in your business, so you aren’t scrambling to do them when change is forcing you to.

Frank: My final question is that, as a startup founder looking at what is going on macro-economically, how should you study it? What advice do you give for understanding what is going on and the potential impact?

Vaughn: It’s a great question. There are many correct answers to this. But the key is in trying to look at interdependencies. For instance, in regards to China, if I was a startup CEO and looking at China as a source of supply — then I would look at whether your supply chain/product that emanates from China depends on supply chains going into China that would be severely affected by exchange rate risk. For example, if you are manufacturing product where the raw materials are almost exclusively produced inside China, you are probably fairly well insulated from major fluctuations in the cost of goods sold based on low currency exchange risk. However, if your product relies on raw materials coming into China from all over the world, you might start seeing a lot of your product costs fluctuating much more than you would want.

And if you are thinking about China as a source of demand, then I would consider the possibility that China is not demographically as it is presented — it has been presented in recent years as a rapidly expanding wealthy middle class with strong buying power. But China is a massive country with a much more diverse population than that, and you should watch the retail numbers very closely to see if there is a growing impact of the stock market and currency changes on the purchasing power of this sector of the Chinese economy.

However, let me finish by saying that as individuals, as humans, we tend to think about risk a lot and try to make bets and predict future outcomes. However, as we move into more interdependent economies and rapidly changing environments in which we do business, we need to become a lot more ok with simply not knowing what is going to happen and try not to react too quickly to change. Instead, as a CEO, you should be putting in place the things I’ve talked about above to ensure you and your teams can assess and adapt calmly to rapid changes around you.

Frank Meehan is cofounder and partner at SparkLabs Global Ventures, which has over 50 startup investments around the world and is the sister company to SparkLabs Korea: Asia’s largest accelerator. He is also the cofounder of www.SmartUp.io , a free app for startups that Apple selected among its “Best Apps of June 2015.”

VB’s research team is studying web-personalization…

Chime in here, and we’ll share the results.

Excerpt from –

What the China stock market crash means for startups | VentureBeat …