As the stock market gets rocked, let's remember … – Business Insider

UBSUBS’s Julian Emanuel highlighted this in a July note to clients.

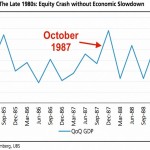

The Dow Jones Industrial Average plunged a shocking 508 points — or about 22.6% — back on October 19, 1987.

But as scary as that drop was, US economic growth was resilient, and gross-domestic-product growth never went negative.

This little anecdote about the 1987 crash is important to remember in light of this week’s hemorrhaging stock market.

The big takeaway here is: although a huge sell-off could slow the economy and potentially lead it into a recession, it does not necessarily mean that it’ll turn into a global financial crisis.

In fact, analysts have previously suggested that stock-market crashes typically lead to less severe recessions than something like, for example, a housing crash or a credit crisis.

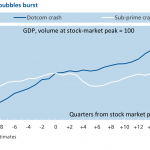

Notably, Lombard Street Research’s Dario Perkins compared the effect on GDP from both the dotcom crash and the subprime-mortgage crisis, showing that GDP continued to rise during the former, as it didn’t affect housing prices.

Lombard Street Research

Stock-market crashes are scary and come with pain. But there are scarier things out there if you’re thinking about risks to the economy.

SEE ALSO: This brilliant world map shows countries scaled to the size of their stock markets

More:

As the stock market gets rocked, let's remember … – Business Insider