REVEALED: George Soros Doubled His Bet That The Stock Market …

REUTERS/Bernadett Szabo

George Soros

One day every quarter, the world’s big fund managers reveal some of what they’re buying and selling in their 13-F regulatory filings.

Generally speaking, these revelations aren’t taken too seriously as they are 45-day-old snapshots. But over the weekend, one gigantic $1.3 billion position raised some eyebrows.

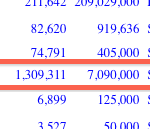

Soros Fund Management disclosed that it held put options on 7,090,000 shares of the SPDR S&P 500 ETF (SPY) at the end of Q4.

Puts protect the holder of the option from declining prices. Soros’ position makes money if $1.3 billion worth of the SPY declines in value.

And at $1.3 billion, this represents the largest position in the portfolio.

After touching an all-time high of 1,850 in January, the S&P 500 got hit with some volatility that brought the index down by around 6%. However, markets have been coming back, and now the S&P is less than 1% away from setting a new high.

This is not a totally new position for Soros. At the end of Q3, the fund held just 2,794,100 of these options. At the end of Q2, the fund held puts on 7,802,400 shares.

Again, these 13-Fs reveal holdings as of the end of Q4. So, we do not know if and how that position has changed since then.

SEE ALSO:

GOLDMAN: Here’s What Our Clients Worry About The Most

Originally from –

REVEALED: George Soros Doubled His Bet That The Stock Market …

See which stocks are being affected by Social Media